Why should an Indian group adopt a foreign route to acquire strategically important domestic business?

The country’s fastest growing business house of the day, Ahmedabad-based Adani Group, is reportedly entering into cement business by acquiring two major companies of the Indian cement industry from world’s second largest cement producer, Holcim of Switzerland. The deal is worth more than Rs 50,181 Cr. Strangely, none of the India-based Adani Group companies is involved in the acquisition process. Interestingly, the net worth of the so called acquirer of the two large Indian cement conglomerates at the end of fiscal 2022 was less than Rs 20 lakh!

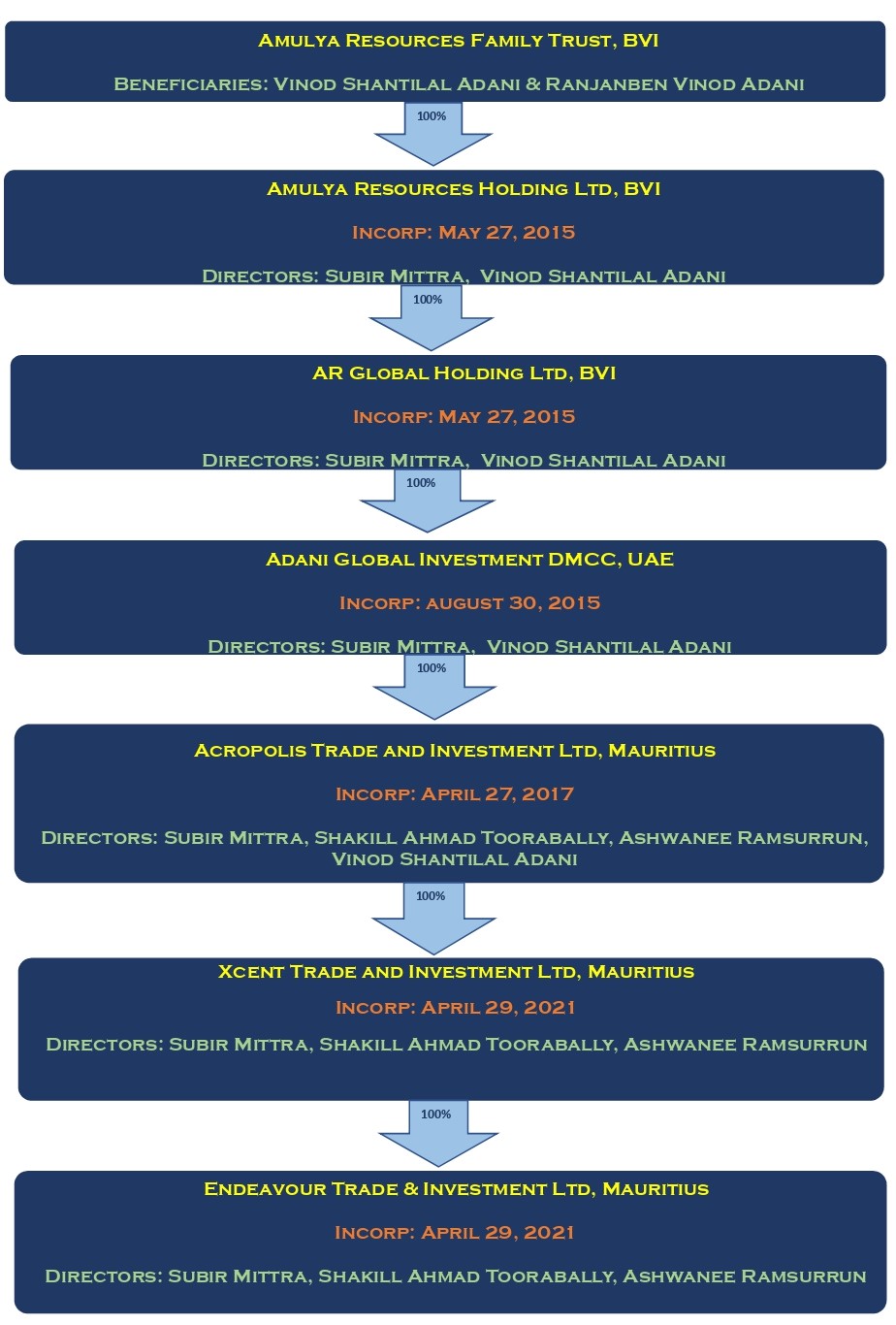

To acquire Ambuja Cements Ltd (ACL) and ACC Ltd (ACCL), Adanis have adopted a complex route. The main face of the group, Gautam Adani, does not come in the picture. The takeover process is executed via elder sibling, Vinod Adani, a citizen of Cyprus, a resident of Dubai and Singapore and a director of dozens of companies & trusts spread across many tax havens like Mauritius and British Virgin Islands (BVI).

The acquirer of ACL/ACCL is the Mauritius-registered Endeavour Trade and Investment Ltd which is 100% owned by another Mauritius-based company, Xcent Trade and Investment Ltd, which is again 100% owned by Acropolis Trade and Investment Ltd which too is a Mauritius incorporated company. Acropolis Trade is held 100% by Adani Global Investment DMCC, a UAE incorporated company. Adani Global is held 100% by AR Global Holding Ltd, a BVI incorporated company. AR Global is held 100% by another BVI incorporated company Amulya Resources Holding Ltd which is held 100% by Amulya Resources Family Trust, a BVI incorporated trust. The ultimate beneficial ownership of the acquirer thus goes to Vinod Adani and his spouse Ranjanben Adani.

The offer document says: “The Underlying Transaction and the Open Offer shall be funded by the Acquirer by way of a combination of equity, offshore debt, liquid equity investment and available cash”. A facility agreement dated July 25, 2022, for availing a maximum amount of USD 3,500 mln (approx. Rs 28,000 Cr) has been entered into between the acquirer (Endeavour Trade) as the borrower and hordes of foreign banks namely DBS Bank, MUFG Bank, Singapore Branch, Intesa Sanpaolo S.p.A. Singapore Branch, First Abu Dhabi Bank, Sumitomo Mitsui Banking Corporation Singapore Branch, Mizuho Bank, Citibank N. A., Hong Kong Branch, ING Bank N.V. Singapore Branch, BNP Paribas, acting through its Singapore Branch, Emirates NBD Bank and Qatar National Bank, Singapore Branch, as lenders.

Another facility agreement dated July 25, 2022 for availing a maximum amount of USD 1,000 mln (approx. Rs 8,000 Cr), has been entered into between Xcent Trade and Investment Ltd as the borrower and the lenders viz. Standard Chartered Bank (Singapore) DBS Bank, MUFG Bank Singapore Branch, Intesa Sanpaolo S.p.A., Singapore Branch, Barclays Bank PLC and First Abu Dhabi Bank.

To lend a whopping amount of about Rs 36,000 Cr, what are the financials of Endeavour Trade and Xcent Trade? At the end of fiscal 2022, Endeavour had no revenue but incurred a loss of Rs 20 lakh. The company did not have any asset. Its net worth was only Rs 18 lakh. Xcent too had no revenue in fiscal 2022 but incurred an identical loss of Rs 20 lakh. This company had a net worth of Rs 56 lakh. The only asset of this company was investments worth Rs 38 lakh.

The offer document does not reveal the financials for fiscal 2022 of Xcent’s holding company, Acropolis Trade. This company has a highly fluctuating past which is far from convincing. In fiscal 2019 Acropolis had nil revenue and incurred a net loss of Rs 16 lakh. Its net worth was negative Rs 23 lakh. For fiscal 2020 Acropolis’s income from operation amounted to Rs 265 lakh but the company posted a whopping loss of Rs 7,080 Cr due to non-operating deficit of Rs 7,083 Cr. In fiscal 2021 Acropolis’s operating income shot up to Rs 9,372 Cr and `other income’ pole-vaulted to Rs 42,039 Cr which resulted in a net profit of Rs 51,410 Cr!

Acquirer and Holding Companies’ Financial Track

| (Rs in lakh) |

Endeavour Trade |

Xcent Trade |

Acropolis Trade |

||

| Date of Incorporation |

29-Apr-21 |

29-Apr-21 |

27-Apr-17 |

||

| Year Ended |

Mar-22 |

Mar-22 | Mar-21 | Mar-20 |

Mar-19 |

| Stated Capital |

8 |

8 | 906 | 930 |

7 |

| Share Application Money |

30 |

68 | 0 | 0 |

0 |

| Redemption Reserve |

0 |

0 | 5,31,104 | 18,43,001 |

0 |

| Retained Profit (Loss) |

-20 |

-20 | 44,50,585 | -7,08,125 |

-29 |

| Net Worth |

18 |

56 | 49,82,595 | 11,35,805 |

-23 |

| Amounts Payable |

12 |

12 | 6,74,066 | 4,90,435 |

461 |

| Total Source of Funds |

30 |

68 | 56,56,662 | 16,26,240 |

439 |

| Investments |

0 |

38 | 41,69,451 | 14,74,065 |

28 |

| Current Assets |

30 |

30 | 14,87,211 | 1,52,175 |

411 |

| Income from Operations |

0 |

0 | 9,37,185 | 265 |

0 |

| Other Income |

0 |

0 | 42,03,868 | -7,08,316 |

0 |

| Total Income |

0 |

0 | 51,41,053 | -7,08,052 |

0 |

| Net profit |

-20 |

-20 | 51,41,040 | -7,08,086 |

-16 |

If the foreign banks are willing to lend USD 4,500 mln (Approx. Rs 36,000 Cr) for the companies who have obscure financials, one can imagine how much influence that the Adanis have over the alien lenders.