Indian promoter, who sold the company on the eve of its Silver Jubilee to an MNC, buys back from another MNC on the eve of Golden Jubilee!

But, what’s surprising is the price at which that the MNC has sold its stake to the original promoter at a time when the company has achieved its best performance. Why should the MNC sell its stake `dirt-cheap’, at less than one-third of the peak price? Has the alien parent lost faith in its Indian subsidiary, or is it favoring the Indian promoter in a `special’ way? As the below-the-market-price transaction has sizably eroded retail investors’ wealth, surely, the deal warrants market regulators’ attention. As the undervaluation has caused loss to the exchequer in terms of capital gain tax, this becomes a fit case for the IT Department to probe into.

|

MNC selling a highly profitable company at more than 50% discount to peak market value? |

||||

| Description |

Price/DPS |

Holding % | No. of Shares |

Rs Cr |

| Peak Maket Value |

1887 |

75.00 | 1,31,89,219 |

2489 |

| Amount received from Indian promoter |

600 |

61.19 | 1,07,60,644 |

646 |

| Sale through the Exchange on day 1 (Aprox.) |

913 |

12.37 | 21,74,807 |

198 |

| Sale through the Exchange on day 2 (Aprox.) |

826 |

1.44 |

2,53,233 |

21 |

| Special Interim Dividend Received |

192 |

75.00 |

1,31,89,219 |

253 |

| Second Interim Dividend Received |

105 |

61.19 | 1,07,60,644 |

112 |

| Amount realized as per disclosed sources |

1230 |

|||

| Implied discount to the peak market value |

1259 |

|||

| Implied loss to the MNC? |

% |

50.57 |

||

INEOS Styrolution India Limited (ISIL) is the number one producer of Absolac (ABS) and Absolan (SAN) in India. ABS is a plastic resin produced from acrylonitrile, butadiene and styrene, used for manufacturing home appliances, automobiles, consumer durables and machinery. Absolan (SAN) is a polymerized plastic resin produced from styrene and acrylonitrile, and mainly used for products such as lighting, stationery, novelties, refrigerators and cosmetic packing. With 42 years of pioneering experience, ISIL has reportedly been the most preferred supplier to its customers.

The MNC parent of ISIL, INEOS Styrolution, a global leader in styrenics, announced recently that it had entered into an agreement for the sale of its entire shareholding in ISIL (61.19%) to Shiva Performance Materials (SPM) – part of the Vadodara-based Shiva Group, which has businesses in specialty chemicals for pharmaceuticals, agrochemicals and other intermediates.

Incidentally, the promoter-chairman of Shiva Group, Rakesh Agrawal, was the one who had reportedly introduced Engineering Thermoplastics in India by setting up ABS Plastics Ltd – the original avatar of ISIL. He led ISIL’s operations until 2012 as a Managing Director, though he had sold the company to Bayer AG in 1997. Interestingly, on the eve the company’s Silver Jubilee Rakesh Agrawal sold the company, and on the eve of its Golden Jubilee he has bought it back!

On selling ISIL to the Shiva Group, the CEO of INEOS, Steve Harrington, had to say about ISIL’s future: “The business continues in Shiva Performance Materials’ experienced hands, serving the existing customer base and seeking future growth potential to enhance the Company’s current position in the Indian market”.

The acquirer, Shiva Performance Materials (SPM) is a relatively small company as compared to Ineos India (ISIL). SPM’s financials are none too impressive. Its net worth at the end of fiscal 2022 was less than Rs 60 Cr. Yet, it has bought 61.19% of ISIL for a consideration of more than Rs 645 Cr! No doubt, the acquisition would enable SPM, a leading manufacturer of Acrylic Resins, Resin Solutions and Emulsions for Graphic Arts Industry (Printing and Packaging applications), to expand its product portfolio and command a market leadership position in the ABS (Acrylonitrile Butadiene Styrene) and SAN (Styrene Acrylonitrile) market in India. But, will it benefit the public shareholders of ISIL? SPM is comparatively a much smaller company with lower profit margin which will certainly work against the interest of the public shareholders of ISIL if SPM goes for a reverse merger.

|

HOW INEOS INDIA COMPARES WITH ITS ACQUIRER SHIVA PERFORMANCE |

||||||

| (Rs in Cr) |

Ineos Styrolution India |

Shiva Performance Materials |

||||

| Year Ended |

Mar-22 |

Mar-21 | Mar-20 | Mar-22 | Mar-21 |

Mar-20 |

| Revenue |

2179 |

1631 | 1579 | 303 | 162 |

60 |

| Operating Profit |

475 |

414 | 65 | 21 | 22 |

4 |

| OPM% |

21.8 |

25.4 | 4.1 | 7.1 | 13.3 |

7.4 |

| Other Income |

14 |

13 | 7 | 1 | 2 |

1 |

| EBIDTA |

488 |

427 | 72 | 23 | 23 |

5 |

| EBIDTA % |

22.3 |

25.9 | 4.5 | 7.4 | 14.1 |

8.7 |

| Interest |

8 |

15 | 16 | 2 | 1 |

0 |

| Depreciation |

38 |

36 | 32 | 7 | 10 |

5 |

| Except Item |

0 |

0 | -38 | 0 | 0 |

0 |

| Tax |

116 |

94 | 1 | 4 | 3 |

0 |

| Net Profit |

323 |

280 | -10 | 9 | 9 |

0 |

| Equity |

18 |

18 | 18 | 7 | 7 |

7 |

| Reserves |

839 |

871 | 592 | 53 | 44 |

35 |

| Borrowing |

10 |

33 | 145 | 3 | 3 |

3 |

| Fixed Assets |

350 |

401 | 421 | 43 | 45 |

51 |

| Promot Stake % |

61.19 |

75.00 | 75.00 | 100.00 | 100.00 |

100.00 |

ISIL Evolution

1973: Incorporated as ABS Plastics Ltd on December 7, 1973, by Rakesh Agrawal a chemical engineer from the US and J. J. Mehta who had over fifty years of experience in the petrochemical and engineering industries.

1978: ABS Plastics commences production.

1992: ABS Plastics Ltd changes name to ABS Industries Ltd.

1997: On the eve of the company’s Silver Jubilee Rakesh Agrawal sells ABS Industries Ltd and the company was rechristened as Bayer ABS Ltd after Bayer AG acquired a majority share of 51%.

2004: Bayer Group decides to restructure its business globally. The company becomes a part of LANXESS and its name is changed to LANXESS ABS Ltd.

2008: INEOS ABS (Jersey) Ltd, UK, acquires a major stake constituting 83.33 % of total paid up capital of the company, thereby becoming the holding company of LANXESS ABS Ltd and the company is renamed INEOS ABS (India) Ltd effective June 17, 2008.

2012: Styrolution (Jersey) Ltd, UK, acquires a major stake constituting 87.33 % of total paid up capital of the company, thereby becoming the holding company and the name is changed to Styrolution ABS India Ltd effective May 1, 2012.

2014: As a part of a global strategic joint venture, Styrolution (Jersey) Ltd transfers its entire holding of 75% equity shares to Styrolution South East Asia Private Ltd, Singapore, the latter thereby becoming the holding company of Styrolution ABS India Ltd (SIL) effective January 28, 2014.

The Board of Directors of SIL approved the consolidation of two entities — Styrolution India Private Limited (SIN) and Styrolution ABS (India) Ltd — on November 30, 2013. Subsequently, SIL acquired 100% equity in SIN to make it a wholly-owned subsidiary on March 1, 2014.

2016: The name of the Company was changed from Styrolution ABS (India) Ltd to Ineos Styrolution India Ltd effective from March 18, 2016. Styrolution India Private Ltd legally ceases to exist and is declared merged with INEOS Styrolution India Ltd (SIL) effective March 31, 2016.

2022: On the eve of the company’s Golden Jubilee, its original promoter Rakesh Agrawal regains the control of the company from the INEOS group acquiring 61.19%at a cost of over Rs 645 Cr.

|

SEVEN NAMES IN TWENTY-FOUR YEARS ! |

|

| NAME |

DATE |

| ABS PLASTICS LTD |

07-12-1973 |

| ABS INDUSTRIES LTD |

06-08-1992 |

| BAYER ABS LTD |

01-07-1997 |

| LANXESS ABS LTD |

29-04-2005 |

| INEOS ABS (INDIA) LTD |

17-06-2008 |

| STYROLUTION ABS (INDIA) LTD |

01-05-2012 |

| INEOS STYROLUTION INDIA LTD |

18-03-2016 |

The transaction between INEOS and SPM has triggered a mandatory tender offer to the non-promoter shareholders. The company has fixed a price of Rs 848.72 for a share which is the `volume-weighted average market price’ of the shares for a period of sixty trading days immediately preceding the date of the public announcement i.e. August 1, 2022 as traded on NSE. The tender offer is scheduled to open on September 21, 2022. Since the current market price of the stock is hovering above Rs 900, no public investor is expected to tender the shares. Hence, the open offer has become meaningless.

However, what’s intriguing is how the MNC agreed for a price of Rs 600 for a stock which has quoted above this price for last 20 months. The sale price is only 32% of the peak price registered by the stock last year. Further, it discounts the company’s EPS of Rs 183 just 3.3times which is dirt-cheap. At a time when the market commands a P/E of more than 20x, will any rational promoter sell his stake so cheap?

|

INEOS Styrolution Track Record (Rs Cr) |

|||||

| Year Ended |

Mar-22 |

Mar-21 | Mar-20 | Mar-19 |

Mar-18 |

| Revenue | 2179 | 1631 | 1579 | 2091 | 1951 |

|

Operating Profit |

475 | 414 | 65 | 8 | 135 |

|

OPM% |

21.8 | 25.4 | 4.1 | 0.4 |

6.9 |

|

Other Income |

14 | 13 | 7 | 13 | 7 |

|

EBIDTA |

488 | 427 | 72 | 21 |

142 |

|

EBIDTA % |

22.3 | 25.9 | 4.5 | 1.0 |

7.3 |

| Interest | 8 | 15 | 16 | 13 | 14 |

|

Depreciation |

38 | 36 | 32 | 27 | 25 |

|

Except Item |

0 | 0 | -38 | 0 |

0 |

|

Tax |

116 | 94 | 1 | 0 | 39 |

|

Net Profit |

323 | 280 | -10 | -12 | 66 |

|

Dividend Amount |

522 | 18 | 0 | 4 |

7 |

|

Equity |

18 | 18 | 18 | 18 |

18 |

|

Reserves |

839 | 871 | 592 | 606 | 627 |

|

Borrowing |

10 | 33 | 145 | 252 |

104 |

|

Fixed Assets |

350 | 401 | 421 | 296 |

229 |

|

Promoter Stake % |

61 | 75 | 75 | 75 |

75 |

|

Book Value |

487 | 505 | 346 | 354 | 366 |

|

Earnings Per Share |

183 | 159 | -5 | -7 |

38 |

|

Dividend % |

2970 | 100 | 0 | 20 |

40 |

|

Dividend Per Share |

297 | 10 | 0 | 2 |

4 |

|

Pay-out % |

162 | 6 | 0 | (-) | 11 |

|

Closing Price |

974 | 936 | 514 | 524 |

863 |

|

Fiscal High |

1887 | 1115 | 804 | 938 |

1169 |

|

Fiscal Low |

926 | 484 | 365 | 485 |

683 |

Failure of Professional Management & Independent Directors

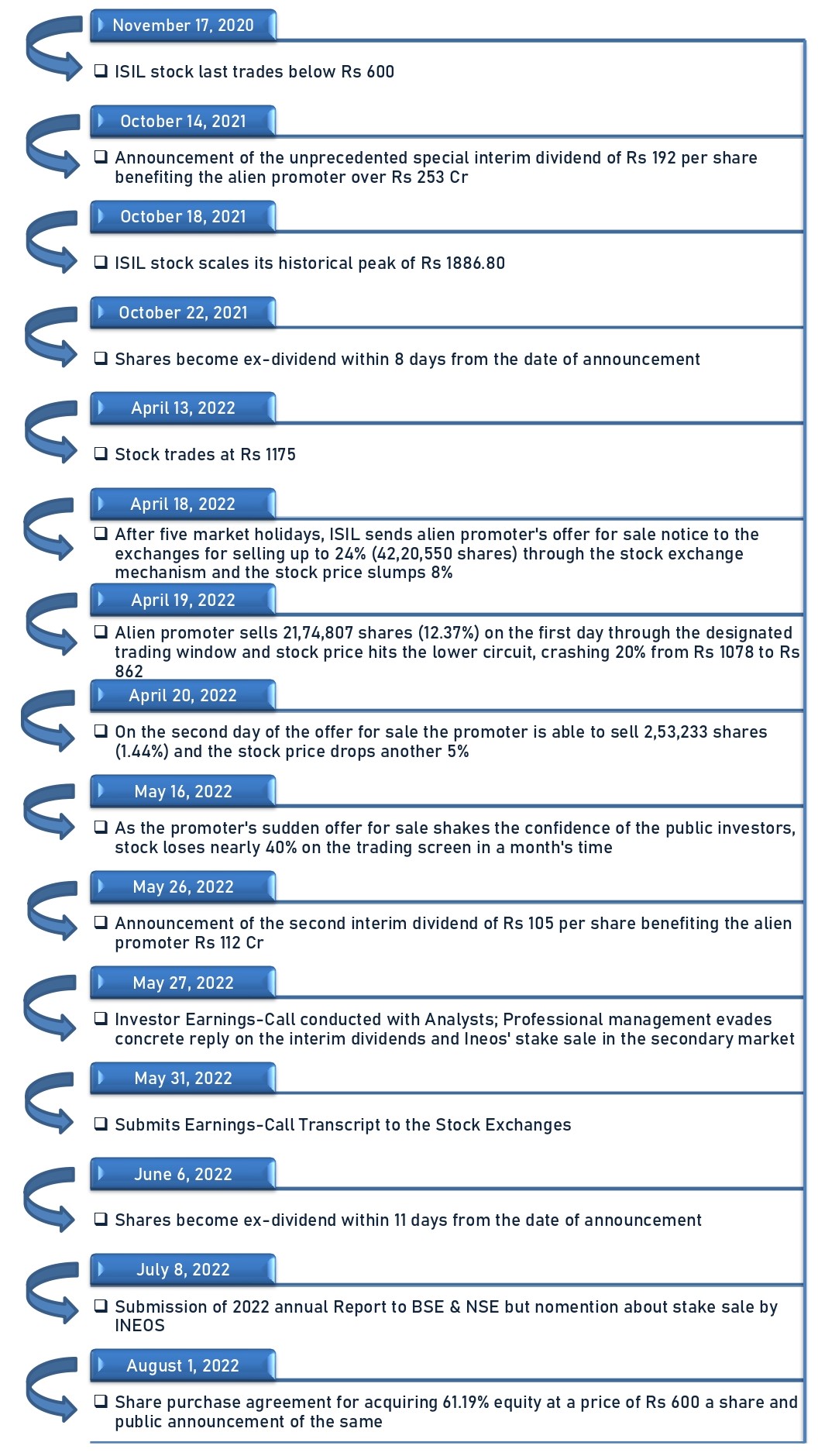

The chronological events that preceded the share purchase agreement dated August 1, 2022 give a feeling that there was a pre-planned strategy to arrive the price of Rs 600 ignoring the ruling market rate.

In the secondary market, the stock has never quoted below Rs 600 after November 17, 2020. On the contrary, enthused by the highly encouraging financial performance, the stock was seeking new peaks in 2021. But, despite a surge in earnings during the fiscal 2022, the stock became lackadaisical in 2022.

In its five-decade history, the company had never declared any interim or special dividend. It paid only ‘final’ dividends that too at a poor payout ratio. Quite contrary to this record, the company declared a fabulous special interim dividend of Rs 192 per share in October 2021, which saw the stock scaling its historical peak of Rs 1886.80. Why should the company turn a liberal distributor suddenly in 2021? Obviously, the promoter had intended to reap a whooping Rs 253 Cr dividend before selling his stake!

|

ISIL’s DIVIDEND DISTRIBUTION RECORD |

||||||

| YEAR-END |

EPS |

DPS | PAY-OUT% | DIV % | DIV. TYPE |

EX-DIV. DATE |

|

Mar-22 |

183.40 | 297 |

162 |

1050 |

INTERIM |

06-06-2022 |

|

1920 |

INTERIM SPL |

22-10-2021 |

||||

| Mar-21 |

159.30 |

10 |

6 |

100 |

FINAL |

05-08-2021 |

| Mar-20 |

-5.40 |

0 |

0 |

0 |

– |

– |

| Mar-19 |

-7.10 |

2 |

– |

20 |

FINAL |

31-07-2019 |

| Mar-18 |

37.70 |

4 |

11 |

40 |

FINAL |

01-08-2018 |

| Mar-17 |

39.40 |

4 |

10 |

40 |

FINAL |

02-08-2017 |

| Mar-16 |

36.30 |

4 |

11 |

40 |

FINAL |

04-08-2016 |

| Mar-15 |

19.90 |

4 |

20 |

40 |

FINAL |

29-07-2015 |

| Dec-13 |

28.72 |

4 |

14 |

40 |

FINAL |

16-04-2014 |

| Dec-12 |

35.90 |

4 |

11 |

40 |

FINAL |

10-04-2013 |

| Dec-11 |

30.69 |

4 |

13 |

40 |

FINAL |

12-04-2012 |

Even while the company was reporting improved performance in fiscal 2022 as compared to the previous year, the stock price became lacklustre post payment of the special interim dividend. From a peak of Rs 1886 in October 2021, the stock price receded to Rs 1175 on April 13, 2022. After five market holidays, on April 18, 2022, the company sent its promoter’s offer for sale notice to the exchanges for selling up to 24% (42,20,550 shares) through the stock exchange mechanism. This caused 8% slump in the stock price.

On April 19, 2022, the promoter sold 21,74,807 shares (12.37%) through the designated trading window and stock price hit the lower circuit, crashing 20% from Rs 1078 to Rs 862. Next day another 2,53,233 shares (1.44%) were sold and the stock price dropped further 5%. A question that arises here is, if the purchase agreement was dated August 1, 2022, the discussions related to the promoter’s stake sale would have taken place few months earlier, then why should the promoter resort to offloading in the secondary market depressing the stock price, when there was an impending share purchase agreement with the Shiva Group?

The promoter’s sudden offer for sale shook the confidence of the public investors and the stock conceded nearly 40% in a month’s time. Before the heat of the promoter’s offer for sale got over, on May 26, 2022, the company came out with another interim dividend of Rs 105 per share! There was an investor Earnings-Call on May 27, 2022, and the analysts questioned about the dividend policy of the company as well as Ineos’ stake sale in the secondary market for which the professional management failed to provide a concrete reply. How the traditionally conservative management turned ultra-liberal declaring a second interim within eight months? Obviously, the promoter had to receive Rs 112 Cr before their sell-off to the Shiva Group!

The professional management hid the impending stake sale to the new promoter at the Earnings-Call in May 2022. Also, the 2022 Annual Report submitted to BSE & NSE on July 8, 2022 failed to mention anything about the impending Purchase Agreement. This is the quality of corporate governance practiced by the so called professional management!