Underplaying the Daud Ali-Peacock Industries connection raises serious credibility issues. In the so called `disclosure era’ Sebi has failed to enforce disclosure on promoter’s hidden link!

When the parent company, which controls 92%, was discounted at less than 15 times its consolidated earnings on the trading floor until recently, how could one value its subsidiary’s IPO more than 38 times its earnings, that too at a time when many an industry peer is available at a P/E multiple of less than 15x?

|

SAH POLYMERS OFFER AT A GLANCE |

|

| Offer Type | Book Built |

| Platform | Main Frame |

| Fresh Issue | 1,02,00,000 equity shares (Rs 66.30 Cr) |

| Offer for Sale | NIL |

| Face Value | Rs 10 |

| Price Band | Rs 61 – 65 |

| Mkt/Bid Lot | 230 Nos. |

| Market Cap | Rs 167 Cr (at cap price) |

| Equity Cap | Rs 25.79 Cr |

| Implied Free Float | 39.54% |

| Lead Manager | Pantomath Capital |

| Registrar | Link Intime |

| Listing At | BSE, NSE |

|

INDICATIVE ISSUE SCHEDULE |

|

| Opening : 30-Dec-2022 | Closing : 04-Jan-2023 |

| Allotment : 09-Jan-2023 | Refunding : 10-Jan-2023 |

| Demat Credit : 11-Jan-2023 | Trading : 12-Jan-2023 |

The Offer

Registered at Udaipur, but headquartered in the financial capital of India, Sah Polymers Ltd (SPL) is floating an IPO of 1,02,00,000 equity shares (Rs 66.30 Cr at the cap price). The IPO is, in fact, a fresh issue from the company. The offer is being made through the book-building route with a price band of Rs 61-65 for Rs 10 paid-up share. Incidentally, in October 2021 the company had filed a draft red herring prospectus for floating an IPO of only 57 lakh shares.

Applicants should bid for a minimum lot of 230 shares and multiples thereof. The shares are proposed to be listed on the main frame of BSE and NSE on Thursday, January 12, 2023. Pantomath Capital is acting as the lead manager to the offer and Link Intime has been roped in as registrar to the issue. The bidding opens on Friday, December 30, 2022 and closes on, Wednesday, January 4, 2023.

SPL proposes to utilize the net proceeds from the fresh issue (Rs 66.30 Cr) towards setting up of a manufacturing facility of Flexible Intermediate Bulk Containers (FIBC) (Rs 8.17 Cr), funding working capital requirements (Rs 14.95 Cr) and repayment of loans (Rs 19.66 Cr). The balance amount is earmarked for general corporate purposes.

Lineage

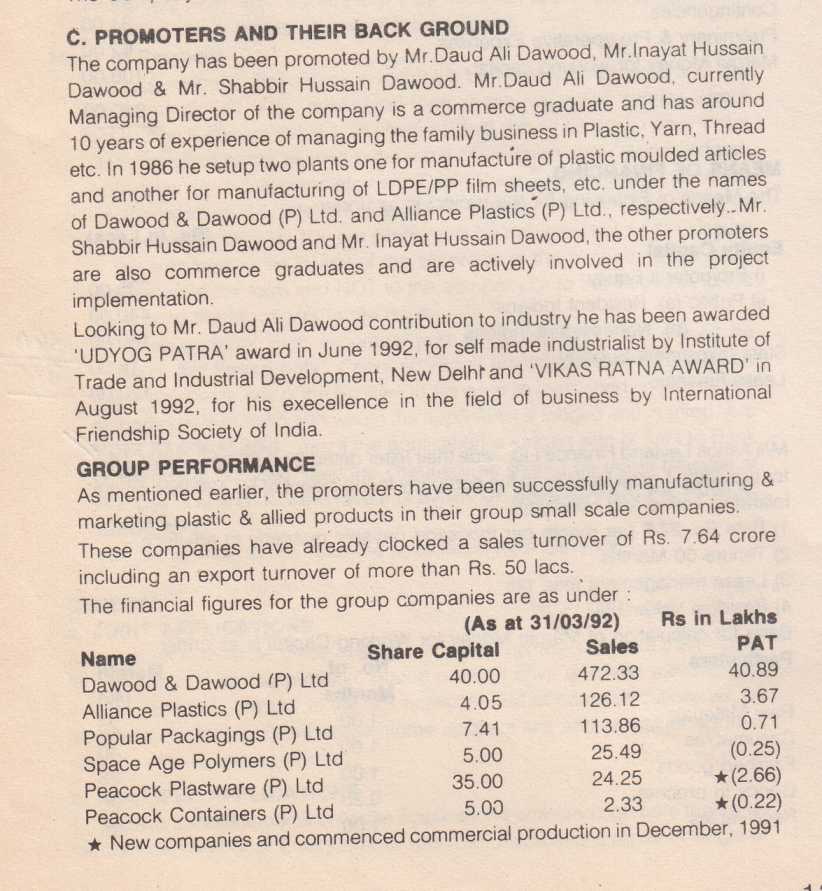

SPL was originally incorporated as Peacock Continental Ltd on April 20, 1992. Daud Ali Dawood, Hatim Ali Dawood, Shabbir Hussain Dawood, Mohammad Hussain Dawood, Rashida Daud, Zuheda Daud and Batool Daud were the initial subscribers to the Memorandum of Association. Incidentally, none of the original signatories seems to be with the company today.

Perhaps, our capital market regulator SEBI, which was established on April 12, 1992, may not be aware of the first signatory of SPL, Daud Ali Dawood, who had founded the Udaipur-based `Peacock’ group a year earlier. In a matter of one year the Peacock group registered four companies viz. Peacock Plastware (P) Ltd, Peacock Containers (P) Ltd, Peacock Industries Ltd (PIL) and Peacock Continental Ltd (SPL).

PIL went public in December 1992 under the aegis of SEBI with an equity issue of Rs 5.9 Cr which was considered a big amount in those days. PIL promised to achieve break-even at just 18.84% capacity utilization and liberally projected a dividend yield of 20% for the first three years. Thirty years have passed since PIL went public. What is the post-IPO track record of the company?

PIL’s losses mounted many times more than its equity capital and the company had to go for a capital reduction to reduce the accumulated deficit. As a result, for many years the share languished below par value. Though during last few years the company has posted healthy top line, its bottom line has been unstable. Consequently, the dividend has remained only in the pipe dream.

PIL is now known as PIL Italica Lifestyle Ltd and its main shareholder is Daud Ali’s Tradetech Private Ltd which is holding 20% in Sat Invest Private Ltd, the so called promoter-company of SPL’s promoter SAT Industries Ltd. Daud Ali’s another promotion, Space Age Polymers is also holding 40% in Sat Invest. Further, DA Tradetech and Space Age Polymers are directly holding 6.38% and 5.85% in SAT Industries. When PIL’s promoter Daud Ali’s indirect stake is so high in SAT industries, How come the offer document of SPL, which was originally promoted by Daud Ali himself, is completely omitting the pathetic post IPO record of PIL?

In fact, SPL’s previous avatar Peacock Continental reportedly commenced operations as a manufacturer of plastic goods on November 04, 1992 and under a business purchase agreement dated 23rd July 1998, Peacock Continental took over of assets and rights comprising of land, building, plant and machinery, etc., on an ongoing concern basis from Peacock Industries Ltd subsequent to which the company’s name was changed to the present one on July 24, 1998. In other words, the public company’s assets were transferred to a privately held group company at the promoters’ will.

Until November 2005 SPL’s equity capital (Rs 145 lakh or 14.5 shares) was held by the initial signatories to the memorandum and their associates. On December 1, 2005 three existing shareholders transferred Rs 50.75 lakh worth of shares (5,07,500 shares) in favour of SAT Industries Ltd (SIL) at par value. Also, between December 1, 2005 and October 27, 2009 SPL issued 55.5 lakh shares at par to SIL which gained control of more than 86% of SPL’s equity. Yet, in 2009, SIL was not considered as SPL’s promoter.

Surprisingly, on November 3, 2009 SIL sold 21.50 lakh shares to Sat Invest Pvt Ltd at Rs 15 each. On January 3, 2012, it sold 20 lakh shares to Lion Houseware Pvt ltd and 19.07 lakh shares to Park Continental Pvt Ltd – both at a price of Rs 15.50 a share. Strangely, after two and a half years, on July 1, 2015 these three private companies sold back 84.21 lakh shares to SIL at a discounted price of Rs 11 per share! And, having acquired 85,21,430 shares representing 54.63% of SPL’s equity SIL became the promoter of the company in 2015. It seems changing ownership of companies is a pass-time for the promoters of the Peacock group!

Coming to the track record of SPL’s corporate promoter, the 38-year-old SIL has had a fluctuating past. Though it managed to post impressive top line in last five years, the company’s bottom line has never been stable. From Rs 21 Cr in fiscal 2017, net profit slid to Rs 7 Cr in fiscal 2018 despite an increase in revenue. Profit recovered to Rs 16 Cr in fiscal 2019 but crashed to Rs 3 Cr in 2020.

SAT’s top line which was on the decline in fiscals 2020 and 2021 witnessed a quantum leap in fiscal 2022 that is on the eve of its subsidiary’s IPO. The company which had paid a dividend of only 5% in three out of five years stepped up the dividend only in 2022 to 7.5%. The share price which was languishing below Rs 20 for nearly three years has shot up beyond Rs 70 as the subsidiary SPL is readying for its IPO.

|

Promoter Sat Industries’ Consolidated Financial Performance (in Cr) |

|||||||

| Period Ended |

Sep-22 |

Mar-22 | Mar-21 | Mar-20 | Mar-19 | Mar-18 |

Mar-17 |

| Months |

6 |

12 | 12 | 12 | 12 | 12 |

12 |

| Revenue |

243 |

347 | 205 | 225 | 229 | 99 |

91 |

| Operating Profit |

31 |

59 | 26 | 16 | 33 | 9 |

4 |

| OPM% |

12.7 |

16.9 | 12.6 | 7.0 | 14.3 | 8.8 |

4.3 |

| EBIDTA |

35 |

63 | 26 | 19 | 34 | 12 |

6 |

| EBIDTA % |

14.3 |

18.1 | 12.8 | 8.5 | 14.6 | 11.4 |

6.3 |

| Interest |

3 |

7 | 8 | 10 | 12 | 2 |

1 |

| Net Profit |

24 |

39 | 9 | 3 | 16 | 7 |

21 |

| Equity |

23 |

23 | 23 | 23 | 22 | 22 |

20 |

| Reserves |

159 |

189 | 149 | 140 | 136 | 69 |

66 |

| Borrowing |

117 |

91 | 62 | 66 | 81 | 27 |

10 |

| Fixed Assets |

90 |

83 | 67 | 67 | 69 | 21 |

20 |

| Promo. Stake % |

51.6 |

51.6 | 51.6 | 51.6 | 54.0 | 54.0 |

54.0 |

| Open Price |

39.75 |

19.15 | 17.70 | 26.00 | 35.65 | 25.50 |

9.05 |

| Year High |

73.85 |

62.4 | 22.80 | 38.45 | 44.25 | 43.80 |

31.90 |

| Year Low |

27.70 |

16.00 | 14.00 | 14.50 | 24.00 | 21.90 |

8.80 |

| Closing Price |

58.45 |

38.80 | 18.35 | 16.80 | 25.70 | 36.55 |

24.55 |

| Div % |

0 |

7.5 | 5 | 0 | 5 | 5 |

0 |

| EPS (Rs ) p.a. |

4.30 |

3.42 | 0.83 | 0.24 | 1.44 | 0.65 |

2.15 |

| P/E |

13.6 |

11.3 | 22.0 | 70.4 | 17.8 | 56.3 |

11.4 |

Key Management

SIL’s Non-executive Director Asad Daud (32) is the Managing director of SPL. He has been associated with the company since April 3, 2009 and claims to have more than 12 years of experience in the polymer packaging Industry.

Hakim Sadiq Ali Tidiwala (65) who was the Managing director of the company since August 1, 1998 has been re-designated as Whole-time Director from November 2, 2015. Even though he does not have a formal higher education (degree), he reportedly has more than 23 years of experience in the polymer packaging Industry.

Chief Executive Officer, Murtaza Ali Moti (39) has been appointed to the post only a year ago, on January 04, 2022. The Company Secretary-cum-Compliance Officer has been appointed since June 04, 2022.

Stakeholders

The entire pre-IPO equity capital of Rs 15.60 Cr (155.96 lakh shares) is held by the promoters. Of this, as much as 91.79% is held by SIL. Post-IPO, on the enlarged equity of Rs25.80 Cr, the promoter group will hold 60.46% of which SIL will have 55.5%.

Business

SPL manufactures and sells Polypropylene (PP)/ High Density Polyethylene (HDPE) FIBC Bags, woven sack, HDPE/PP woven fabrics based products of different weight, sizes and colors as per customer’s specifications. It also offers customized bulk packaging solutions to business-to-business manufacturers catering to different industries such as Agro Pesticides, Basic Drug, Cement, Chemicals, Fertilizer, Food Products, Textiles, Ceramics and Steel.

The company has presence in five states and one union territory for its domestic market sales. Internationally, SPL claims to export its products to 14 countries such as Algeria, Togo, Ghana, Poland, Portugal, France, Italy, Dominican Republic, USA, Australia, UAE, Palestine, UK and Ireland. Currently the company has one manufacturing facility with installed production capacity of 3960 MTPA located at Udaipur, Rajasthan.

Financial Track

SPL, which had posted only a modest performance until fiscal 2021, registered a record turnover of over Rs 80 Cr and a profit of Rs 4.38 Cr. Nevertheless, fiscal 2022’s negative cash flow from operation could dub the highly encouraging 2022 show only a pre-issue bloom! Moreover, as compared to it proposed equity base (Rs 25.80 Cr), its bottom line is too thin to justify the offer price.

|

Sah Polymers Consolidated Financials (in Cr) |

||||

| Period Ended |

Jun-22 |

Mar-22 | Mar-20 |

Mar-19 |

| Months |

3 |

12 | 12 |

12 |

| Revenue |

27.22 |

80.51 | 49.10 |

45.18 |

| Operating Profit |

1.99 |

7.01 | 1.80 |

2.22 |

| OPM% |

7.3 |

8.7 | 3.7 |

4.9 |

| Other Income |

0.37 |

0.72 | 0.81 |

0.43 |

| EBIDTA |

2.36 |

7.73 | 2.61 |

2.65 |

| EBIDTA % |

8.6 |

9.5 | 5.3 |

5.9 |

| Interest |

0.36 |

1.24 | 1.33 |

1.04 |

| Depreciation |

0.28 |

1.01 | 0.77 |

0.71 |

| Tax |

0.41 |

1.09 | 0 |

0 |

| Net Profit |

1.25 |

4.38 | 0.30 |

0.37 |

| Equity (Implied) |

25.80 |

25.80 | 15.60 |

15.60 |

| Reserves (Implied) |

65.49 |

65.49 | 3.67 |

3.60 |

| Borrowing |

33.15 |

30.54 | 10.37 |

11.28 |

| Fixed Assets |

24.90 |

22.30 | 12.70 |

12.60 |

Valuation

The current market discounting of the shares of the promoter-company is any indication, the valuation of SPL’s share is too steep to hold for long.

|

How Sah Polymers compares with its promoter |

||

|

Financials |

||

| (Amount in Cr) |

Sah Polymers |

Sat Industries |

| Market Cap |

168 |

727 |

| Borrowing |

31 |

91 |

| Fixed Assets |

22 |

83 |

| Revenue |

81 |

347 |

| Other Income |

1 |

5 |

| EBIDTA |

8 |

63 |

| Interest |

1 |

7 |

| Net Profit |

4 |

39 |

| Equity Cap |

26 |

23 |

| Reserves |

65 |

159 |

|

Stock Features |

||

| Current Price (Rs) |

65 |

64 |

| Face Value (Rs) |

10 |

2 |

| Book Value |

35.39 |

16.07 |

| Promoter Stake % |

60.5 |

51.6 |

| Debt/Equity |

0.3 |

0.5 |

|

Profitability |

||

| OPM % |

8.7 |

16.9 |

| Net Margin % |

5.4 |

11 |

| Cash EPS |

2.09 |

3.66 |

| Earnings Per Share |

1.7 |

3.14 |

|

Return |

||

| RONW % |

17.5 |

21.3 |

| ROCE % |

12.1 |

21.2 |

|

Discounting |

||

| Price/Earnings |

38.3 |

20.4 |

| Price/Cash EPS |

31.2 |

17.6 |

| Price/Book Value |

1.8 |

4.0 |

| Price/EBIDTA |

21.7 |

11.5 |

| Price/Revenue |

2.1 |

2.1 |

| Price/Fixed Assets |

7.5 |

8.8 |

|

Distribution |

||

| Dividend % |

0 |

7.5 |

| Yield % |

0 |

0.2 |

| Pay-out % |

0 |

4.4 |

Poly sack is a traditionally low margin industry which does not enjoy high P/E multiples. A sound industry player like the dividend-paying Emmbi, who enjoys the highest OPM among the industry peers, is currently discounted at less than 10 times its earnings. Thus, for a promoter group whose credibility is far from convincing, SPL’s projected P/E more than 38x is too costly to bear.

|

HOW SAH POLYMERS COMPARES WITH INDUSTRY PEERS |

||||||

|

Financials |

||||||

| (Amount in Cr) | Sah Poly | Comm. Syn | Emmbi Ind | Jumbo Bag | Rishi Tech | SMVD Poly |

| Market Cap |

168 |

339 | 161 | 21 | 18 |

16 |

| Borrowing |

31 |

77 | 144 | 44 | 20 |

33 |

| Fixed Assets |

22 |

94 | 152 | 26 | 24 |

26 |

| Revenue |

81 |

323 | 436 | 131 | 101 |

86 |

| EBIDTA |

8 |

37 | 49 | 10 | 7 |

7 |

| Interest |

1 |

7 | 15 | 2 | 2 |

4 |

| Net Profit |

4 |

18 | 19 | 5 | 1 |

1 |

| Equity Cap |

26 |

40 | 18 | 9 | 7 |

10 |

| Reserves |

65 |

67 | 136 | 23 | 22 |

13 |

|

Stock Features |

||||||

| Current Price (Rs) |

65 |

85 | 91 | 23 | 25 |

16 |

| Face Value (Rs) |

10 |

10 | 10 | 10 | 10 |

10 |

| Book Value |

35 |

27 | 87 | 36 | 40 |

23 |

| Promoter Stake % |

60.5 |

58.7 | 58.3 | 42.6 | 34.5 |

65.5 |

| Debt/Equity |

0.3 |

0.7 | 0.9 | 1.4 | 0.7 |

1.4 |

|

Profitability |

||||||

| OPM % |

8.7 |

10.4 | 11.3 | 7.1 | 6.3 |

8.1 |

| Net Margin % |

5.4 |

5.6 | 4.4 | 3.8 | 1.3 |

1.3 |

| Cash EPS |

2.09 |

6.95 | 15.86 | 8.23 | 4.67 |

2.83 |

| Earnings Per Share |

1.70 |

4.58 | 10.92 | 5.66 | 1.78 |

1.10 |

|

Discounting |

||||||

| Price/Earnings |

38.3 |

18.5 | 8.4 | 4.1 | 14.0 |

14.7 |

| Price/Cash EPS |

31.2 |

12.2 | 5.8 | 2.8 | 5.4 |

5.7 |

| Price/Book Value |

1.8 |

3.2 | 1.1 | 0.7 | 0.6 |

0.7 |

| Price/EBIDTA |

21.7 |

9.1 | 3.3 | 2.1 | 2.8 |

2.3 |

| Price/Revenue |

2.1 |

1.1 | 0.4 | 0.2 | 0.2 |

0.2 |

| Price/Fixed Assets |

7.5 |

3.6 | 1.1 | 0.8 | 0.8 |

0.6 |

|

Distribution |

||||||

| Dividend % |

0 |

21 | 6 | 0 | 0 |

0 |

| Yield % |

0 |

3 | 1 | 0 | 0 |

0 |

| Pay-out % |

0 |

45.8 | 5.5 | 0 | 0 |

0 |